“New day, new opportunity…” that is how a close friend of mine views everything in life. To be honest, real estate isn’t all that different. Now when I mention real estate, your mind automatically goes to the big tycoons of New York City or the business magnates that are responsible for all the acres of housing that have been developed down in Florida. Although that is a perfect example of real estate in terms of the business side of it, you obviously can understand that real estate could mean that you own a small rental home. So it is something that almost anyone can get his hands on. I am not going to suggest that owning a home is real estate or real estate investing for that matter. As you probably are aware of, your home is the greatest liability you have, because it’s full of expenses and you need to keep feeding it (without it providing any income.)

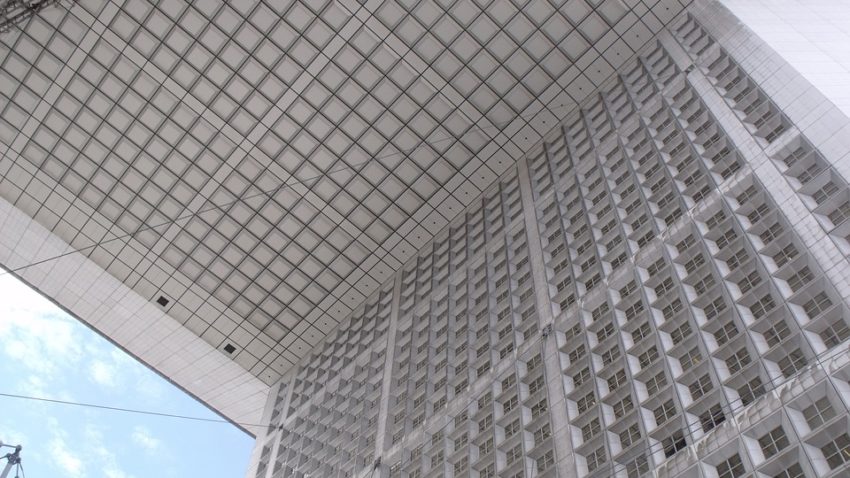

So when we are going to talk about real estate investing, we are talking about apartment complexes, shopping centers, business locations, land etc. Because of the fact that everyone can pretty much get involved with real estate (since you could easily get your feet wet with low six figures,) there are also so many things one needs to know. Because everyone loves owning real estate, the competition levels increase so you have smarter buyers and sellers. So that means you need to become smarter too.

I am going to be offering you some advice for people like you, who are looking to get into the multifamily side of the real estate business. There are some certain rules (some more obvious than others) and I will even cover the topic of getting loans and learning to take advantage of cheep money:

- Observe the condition of the apartment complex. It’s a pretty easy one I guess. You just need to walk into every single home and room of that home and inspect the condition it is in. Your ultimate goal is to be able to balance the rent you would be collecting from the tenants, the life conditions you are offering them, and obviously the price to buy the apartment complex. You want to look at the upside of things. In other words: what kind of improvements will you be able to make, that will boost the value of the investment a few years down the road? So many times these apartment buildings or communities are bought by other real estate investors, so if you are increasing the value of the property (by increasing the rent) you will end up with more money in your pocket, in the case that you decide to sell. But the quality of the homes, are important to note.

- Never buy a deal that has less than 15 units. I know you are probably looking at your bank account and seeing that you can’t exactly deal with the purchase of 15+ units. My statement to that would be: why are you in this condition? (not hitting on your low cash – but you shouldn’t necessarily look at real estate if you don’t have money to do a good job in it) But besides that, you do not want to limit yourself to an apartment deal that offers 15 units or a smaller amount, mainly because of the maintenance. You need to have good enough cash flow, so that you put a company in there to take care of that toilet that breaks in the middle of the night, or that lamp that the tenant is so cheap to replace himself etc. If you have say 50 units, you are still going to only pay for 1 company to manage all this. So by having more units, you minimize your expenses. Low on cash? Deal with it! Real estate isn’t for crybabies, and in fact I will be giving you some advice on how to get loans with no money down.

- Never get into deals in which tenants pay less than $500/month. I mean if you want to keep on chasing after the drug addicts for their rent, be my guest. But if you want one less pain, my suggestion to you would be that you rent to decent people that will at least have your rent on time.

- Never get mad at your money. It is stupid to just look at the kind of money you are looking to spend on purchasing the complex, without looking at the ultimate value the property is offering you. I am not telling you to go blow millions of dollars on deals that are worth a few hundred thousand. But what I am saying, is that you don’t want to play the nickle and dime game with the realtor for a deal you believe is worth it. You will gather the money. Just stick to your gut and the property you like acquiring.

- Raise money. You’ve been waiting for this one for a while. What I mean by that is, if you are in such a miserable condition financially and you feel confident that you can take on a real estate deal without blowing your money, consider getting investors in on the deal with you. Request for specific amounts of money that will cover your down payment, and give them a 7% interest (for example.) Their bank ain’t going to give them anywhere near that, annually. So this answers the question that is bugging you right now “how did he say you can get a loan without a down-payment?” That is obviously not possible. Every bank needs at least 25% of the loan amount as a down-payment. But if you raise that money from relatives, friends or private investors, you are good to go. Of course you will need to be quite the savvy business guy, but you can do it if you work your tail off and you’re smart.

- Always look for an exit, before you even get on the deal. If your goal is to buy an apartment complex that you will need to pay off for 30 years, and then start to collect the income, then you shouldn’t be in real estate probably (unless you are just trying to create a better future for your inheritors.) The whole point of getting on a real estate deal in the multifamily area, is to be able to get out of the deal at some point when you sell the deal at a much greater value than what you purchased it for. I am not saying that getting recurring income is bad. But you should go into these deals with your mind on selling, years down the road.

There are probably so many more things I could have written as my personal little pieces of advice. However, I don’t have the time really to sit down and right every single one on my mind. These are the most important words of wisdom I have to give you, and to be honest many of them, have been expressed by other real estate people. So I’m just bringing the knowledge directly to you. Ask me anything!